The Advantages and Disadvantages of Activity Based Costing

Content

- Prepare a Budgeted Income Statement for the year ended 30 June 2018 using Absorption Costing.docx

- More about Advantages And Disadvantages Of An Activity Based Costing System

- Why is activity-based costing not permitted?

- 3 Using Activity-Based Costing to Allocate Overhead Costs

- Total Overhead Contribution & Accounting Terms

For example, a more established retail business, such as Walmart, has made changes to optimize its strategy for profitability over many years. Their profits are going to remain at a relatively even growth rate, and they know exactly what their cost drivers are. For example, the cost drivers for a manufacturing facility can be the total labor hours and wages paid to employees. Examples of facility level activities are factory management, maintenance, security, plant depreciation. In Activity Based Costing system, facility level activities and costs are treated as period costs as they are found difficult to assign to different products. It is usually quite easy to segregate overhead costs at the plant-wide level, so you can compare the costs of production between different facilities.

The utilization of this method will allow many advantages for business. One is the proper utilization of unit cost compared to its total cost. Likewise, it is helpful in the company’s programs for continuous improvement. The activity-based costing method doesn’t require much understanding to be implemented. This is because it focuses only on the reality on how to undertake the process.

Prepare a Budgeted Income Statement for the year ended 30 June 2018 using Absorption Costing.docx

The state of the art approach with authentication and authorization in IETF standard RADIUS gives an easy solution for accounting all workposition based activities. That simply defines the extension of the Authentication and Authorization concept to a more advanced AA and Accounting concept. Respective approaches for AAA get defined and staffed in the context of mobile services, when using smart phones as e.a. Intelligent agents or smart agents for automated capture of accounting data . Beyond such selective application of the concept, ABC may be extended to accounting, hence proliferating a full scope of cost generation in departments or along product manufacturing.

- However, as the percentages of indirect or overhead costs rose, this technique became increasingly inaccurate, because indirect costs were not caused equally by all products.

- When conducting this process, Hampshire Company took a look at traditional cost method versus activity based costing.

- Florida law prohibits selling gasoline below refinery cost if doing so injures competition.

- If the available resources can not be used properly even after sub contracting the manufacture of any product, the management can do the activity of manufacture of such a product within the firm.

- The use of the single cost driver does not allocate overhead as accurately as using multiple cost drivers.

Hearst Newspapers participates in various affiliate marketing programs, which means we may get paid commissions on editorially chosen activity based costings purchased through our links to retailer sites.

More about Advantages And Disadvantages Of An Activity Based Costing System

Initially, the framework is developed by providing an overview of the product costing, control and decision making process. Also outlined are the various costing systems in terms of their objectives, advantages and deficiencies. A schema for integrating the costing process with decision making and performance evaluation criteria is then conceptualized. The role of ABC is recognized and integrated within this framework.

A primary disadvantage of https://www.bookstime.com/ is that it is not possible to divide some overhead costs such as the chief executive’s salary on a per-product usage basis. ABC will be of limited benefit if the overhead costs are primarily volume related or if the overhead is a small proportion of the overall cost. This method did not account for any specific cost arising from the complexity, diversity or other production related specifics of the product line. In contrary, the time-driven ABC approach does account for all the nuances of each product line. From the table can also be inferred that the practical capacity is not totally used since at the end there is a total of $28,288 of unused resources.

Why is activity-based costing not permitted?

It can assist the operator for selection of material and/or production method, i.e. hours of labour, amount of space, length of melding, efficiency of machinery. However, despite the claimed limitation of ABC, but still have company prefer to implementation of ABC system. Because its can provide most reliability and effective information. Eventhough ABC has consumed most of time and cost to gather information but it can result to get first-hand information for better strategic planning.

What are the advantages and limitations of ABC costing?

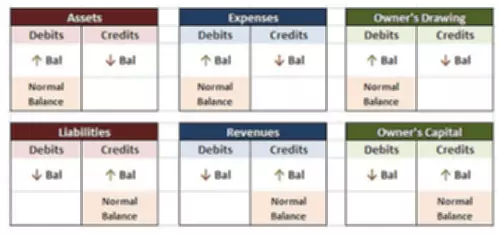

ABC identifies the real nature of cost behaviour and helps in reducing costs and identifying activities which do not add value to the product. With ABC, managers are able to control many fixed overhead costs by exercising more control over the activities which have caused these fixed overhead costs.

It is a costing method that identifies activities in an organization and assigns the cost of each activity to all products and services according to the actual consumption by each. Fewer cost pools used to assign overhead costs to products is not a benefit of activity based costing. Also, ABC able to advise the demand and response for the product and this may help manufacturer to determine the cost allocation for resource, material, marketing plan, etc. In this first case study, ABC system was successfully implemented the “a la carte” style restaurant in Tunisia .

3 Using Activity-Based Costing to Allocate Overhead Costs

In this way, ABC often identifies areas of high overhead costs per unit and so directs attention to finding ways to reduce the costs or to charge more for more costly products. An important component in determining the total production costs of a product or job is the proper allocation of overhead. For some companies, the often less-complicated traditional method does an excellent job of allocating overhead.