NetSuite Applications Suite Removing Undeposited Funds Lines from Deposits

Contents:

At that point, the make deposit function is completed in QuickBooks to pull the undeposited funds onto a deposit slip. The total of this deposit slip should agree with the bank statement at the end of the period. The problem comes when people do not realize that QuickBooks saved the sales receipt or invoice payment to Undeposited Funds. They don’t see the amount in their bank account in QuickBooks, so they enter another deposit directly into the bank account. Now the money received has been recorded twice – once to Undeposited Funds and again to the bank account.

In the Amount field, enter the total amount of all of the lines you checked on the Payments subtab. Using a current date would artificially understate the Design Income for the current period while leaving an erroneous overstatement in the prior period. Next, set up the mapping of the file column related to the QuickBooks field. Dancing Numbers template file does this automatically; you just need to download the Dancing Number Template file. Find the Payment that you wish to Delete from the Particular Undeposited Funds account. Gentle Frog is an independent bookkeeping company, we are not affiliated with Intuit QuickBooks or any bank.

I see people do this with frequency when they have invested in industry-specific bookkeeper definition that feeds into QuickBooks Online. Undeposited Funds are payments that have been received but have not been physically deposited with the bank. This can happen when you enter a customer payment using the Receive Payments form and using the Group with Other Undeposited Funds option. It requires you to do an additional step in the form of multiple entries for each deposit . It is, however, useful for businesses that frequently get paid by check or cash and physically deposit the money to the bank instead of using mobile check deposits. First, find your customer with an open invoice in QuickBooks.

This is important—not only to make sure no income is missing and everything is reported only once. It also matters because it helps you ensure that your receivables and payables accurately match what has occurred in the business. Both the Undeposited Funds and Petty Cash accounts are used to record cash related transactions. However, the Petty Cash account is used exclusively to record daily expenses or income from business operations.

What are the Undeposited Funds in QuickBooks Accounting Software?

You will find Undeposited Funds on your Balance Sheet under Other Current Assets. Reports – This section contains help topics for all reports. Learn how to use the Undeposited Funds account in QuickBooks Desktop.

- Undeposited Funds is a default account in QuickBooks that holds funds from payments to your company until you deposit them to your bank account.

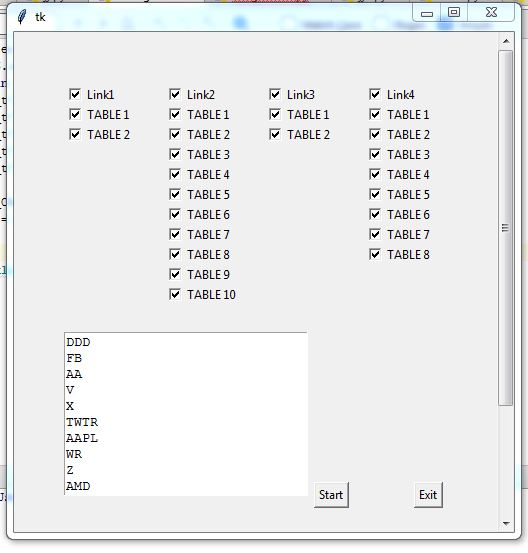

- The “Receivable Journal Summary” report shows Undeposited Payments as the difference between payments received and deposits closed during the dates you select.

- Richard is the kind of man everyone likes to have around.

- Make a note in the Memo field to indicate this entry is to clear an old transaction, and then enter a negative figure in the amount column to offset the original incorrect transaction.

- Marking all incoming client payments to the Undeposited Funds account improves your chances at keeping your file clean, organized, and in good condition.

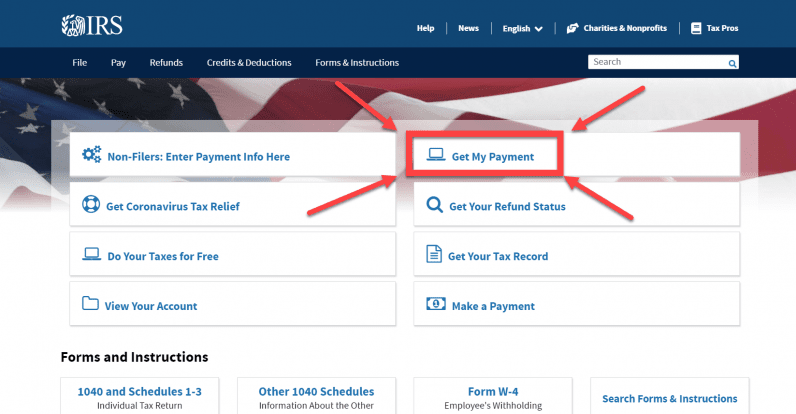

This topic will be our last destination for Cash in our Nonprofit Chart of Accounts Grand Tour. To begin, you need to ensure that the undeposited funds account is enabled in QuickBooks. To do this, go to “Edit” in the menu, select “Preferences” and then choose “Payments”, which is found in the sub-menu on the left side of the screen. Undeposited funds are like a big bag of money or cash drawer that you would keep your checks and cash payments in until you deposit them at the bank. You have already received the money, but it hasn’t been deposited in your account yet. This is the best way to record payments that have not yet been taken to the bank.

Set your financial reporting on autopilot. Goodbye manual work.

Keep reading to learn more about managing the data that has come to life in your company file — specifically, bank deposits. Let’s talk about receiving money from customers via your QuickBooks Online Bank Feed. The problem occurs when the money is entered one day and the deposit is made on a different day. During the interim, the amount will be in undeposited funds. To correct the situation, the deposit date should be changed to agree with the received payment, resulting in a deposit in transit on the bank reconciliation. It’s not an actual bank accounts which is why there’s no option to reconcile it in Total Office Manager.

Outsourcing your bookkeeping is more affordable than you would think. We save you money the moment you hire us by cutting out the expensive cost of hiring an in-house CFO. There are many, many possible reasons that Undeposited Funds can have errors. Richard is the kind of man everyone likes to have around.

So if I delete those Payment transactions it will throw off the AR balance. Most of these transactions are via Square and a few with Quickbook payments. CMP would be happy to help you make the most of your QuickBooks experience and ensure your accounts are up to date and accurate. We provide a vast range of Quickbooks services to suit all your needs.

How to Clean up Undeposited Funds in QuickBooks Desktop?

The Stripe payout contains a large amount of information - including all transactions and fees included in a payout. Most importantly for our purposes here, the Stripe payout contains fees and sometimes other charges that are not contained in the normal transactions we capture. Now review Undeposited Funds again to see if there is still a mismatch in balances. We have written another article to explain the complexities of mismatching on the banking feed which you can reference if needed to understand this issue. At any time, you can view your current Stripe Balance within the Stripe dashboard UI. This number represents the amount of money that Stripe is currently holding on your behalf, waiting to be paid to you in a Stripe payout.

Legislators criticize Bonanza mayor after audit indicates daughter ... - Arkansas Online

Legislators criticize Bonanza mayor after audit indicates daughter ....

Posted: Sat, 03 Dec 2022 08:00:00 GMT [source]

For payments you receive outside of DoorLoop and record manually, you will need to create a bank deposit to show the payment moving out of undeposited funds and into your bank account balance. What you should do instead after saving your sales receipt or invoice payment is go to the Banking menu and create a deposit. QuickBooks will show you a list of the amounts waiting to be deposited. Simply check them off and indicate the bank account for the deposit. This step should parallel the physical deposit you take to the bank.

The undeposited funds account is like a cash box, or storage bin, for your business. Many companies have a credit card processor that dumps all the day’s deposits, less processing fees, into your bank account as one lump sum. If your business falls into that category, you’ll need to use the undeposited funds asset account to unravel it all. Just remember every time you save a transaction, you are affecting accounts in your chart of accounts. This will open the Transaction Journal report and you can see exactly which accounts are being impacted by that transaction.

Undeposited funds are payments you received that have not yet deposited into your bank account. DoorLoop labels a bank account's deposited funds the DoorLoop balance. At the end of the day or next day or even at the end of the week, depending on how often you like to drop off the funds at the bank, you make a run to the bank teller to drop off the deposit.

Nonprofit Accounting Academy

For selecting the file, click on "select your file," Alternatively, you can also click "Browse file" to browse and choose the desired file. You can also click on the "View sample file" to go to the Dancing Numbers sample file. Then, set up the mapping of the file column related to QuickBooks fields. To review your file data on the preview screen, just click on "next," which shows your file data. As a result, It leads to an uncategorized income of your earnings and the payment itself stays as an undeposited fund. Dancing Numbers helps small businesses, entrepreneurs, and CPAs to do smart transferring of data to and from QuickBooks Desktop.

Maryland lawmakers plan hearings on troubled state college ... - The Washington Post

Maryland lawmakers plan hearings on troubled state college ....

Posted: Wed, 04 Jan 2023 08:00:00 GMT [source]

It’s like the lockbox you keep payments in before taking them to the bank. This two-step process ensures Total Office Manager always matches your bank records. Then set the undeposited funds to account by default to automate the transfer of payments made by customers you receive at your end. Thus, this account acts as a buffer to hold the amount until you further deposit the amount in the bank account and the QB register tallies its figure with that on the bank statement. You can send invoices, record sales receipts, receive payments, and deposit them into Undeposited Funds within QuickBooks.

What Is a Deposit in Transit, With an Example - Investopedia

What Is a Deposit in Transit, With an Example.

Posted: Tue, 17 Aug 2021 07:00:00 GMT [source]

This way, you can focus on running your business, and LiveFlow will take care of keeping your books up-to-date. Once the deposit form opens, select the line below the Bob’s Bones payment, and enter Design Income under the From Account column. For example, one of the old items in the Undeposited Funds Account is a receipt from Bob’s Bones for $125, dated in the period two months prior. When clearing your Undeposited Funds Account, you may find that there are transactions in there from a prior period.

In QuickBooks this is termed “Record Deposits.” Now the money is in your bank account. The funds have been received from your customer to your desk drawer and from there they went to your bank. Of course you enter the payment into QuickBooks right away. However you have more capes to clean and will not be going to the bank now. In fact you will likely be receiving many payments today and can’t possibly go to the bank after each payment.

XLS, XLXS, etc., are supported file formats by Dancing Numbers. You can export a Chart of Accounts, Customers, Items, and all the available transactions from QuickBooks Desktop. Bulk import, export, and deletion can be performed with simply one-click. A simplified process ensures that you will be able to focus on the core work. These Funds can also be used to provide Capital for New Ventures. However, Extra Undeposited Money can be an Indication that the Business is Not in Good Health.