What Is the Bid and Ask in Forex? 2022 Update

Contents

Hence if they are investing in this currency, they will usually keep the asking price higher. The prices at which the buyers and sellers are willing to trade are called the bid and ask prices respectively. In Forex, the bid price is the level at which the broker buys a base currency in exchange for the quoted currency. Whereas, the ask price is the level at which s/he sells the base currency for the quoted currency. Understanding how exchange rates are calculated is the first step to understanding the impact of wide spreads in the foreign exchange market. In addition, it is always in your best interest to research the best exchange rate.

The bank always shows two quotes of currency – the one at which it agrees to buy it from you and the one at which it is ready to sell it to you. The spread between these two prices forms the bank’s revenue fxcm review from the foreign exchange operations it performs for you. The forex buyer will always be interested in paying the lowest price for the currency he wishes to purchase and will specify the lowest bid price.

The ask price represents the minimum price that a seller is willing to take for that same security. A trade or transaction occurs when a buyer in the market is willing to pay the best offer available—or is willing to sell at the highest bid. Often, the forex dealer acts on behalf of a business that sells a particular currency that it has received as payment for a product or service sold. The dealer will usually look at the bid price of the currency to set the asking price. A deal will be finalized when the forex dealer finds a trader willing to pay the asking price. In general, dealers in most countries will display exchange rates in direct form, or the amount of domestic currency required to buy one unit of a foreign currency.

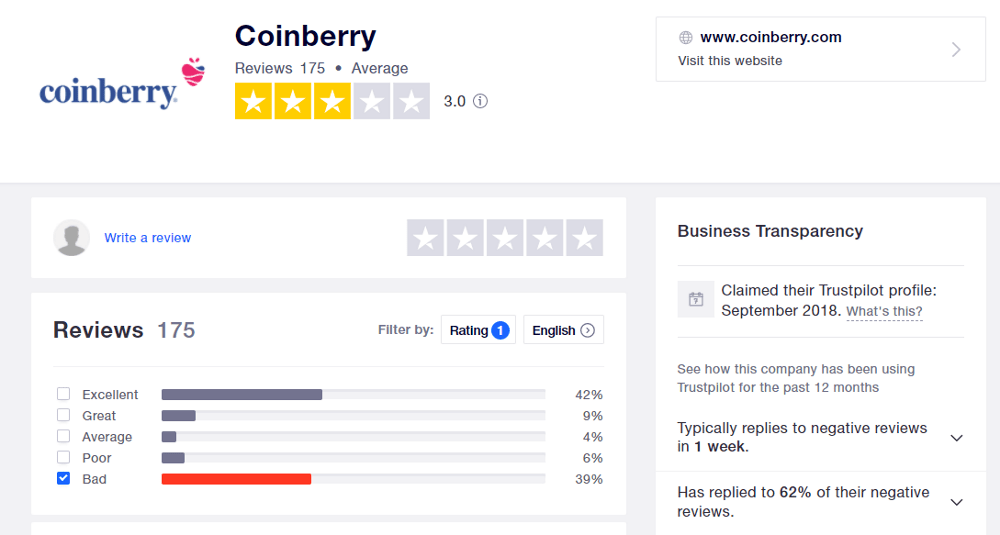

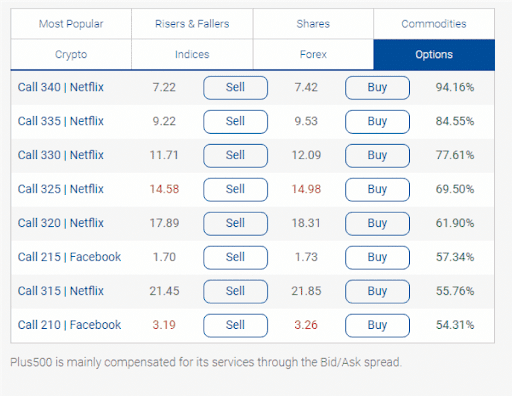

The CFD brokers, like eToro or Plus500, quote a final spread and incorporate their fees into them. In the example below you see the price of bid and ask price is wide and it has 82 pips of spread. If the spread is wider the broker will make more money on each trade you open.

The offers that appear in this table are from partnerships from which Investopedia receives compensation. This compensation may impact how and where listings appear. Investopedia does not include all offers available in the marketplace. Elvis Picardo is a regular contributor to Investopedia and has 25+ years coinbase exchange review of experience as a portfolio manager with diverse capital markets experience. In other words, if a currency quote goes higher, the base currency is getting stronger. I understand that residents of the US are not be eligible to apply for an account with this FOREX.com offering, but I would like to continue.

Preços Bid e Ask. Spread

In case when the bid and ask price are close it means the currency pair is liquid and it is easy to get out from a trade. The foreign exchange, or Forex, is a decentralized marketplace for the trading of the world's currencies. Suppose also that the next traveler in line has just returned from their European vacation and wants to sell the euros that they have left over.

- Go to the Withdrawal page on the website or the Finances section of the FBS Personal Area and access Withdrawal.

- Whereas, the ask price is the level at which s/he sells the base currency for the quoted currency.

- In addition, it is always in your best interest to research the best exchange rate.

- It’s important to keep this in mind if you plan on trading during this three hour window.

- When you click the “New Order” button, a window will appear where you can set the details of your trade.

If one currency is quoted in direct form and the other in indirect form, the approximate cross-currency rate would be "Currency A" multiplied by "Currency B." The bid price is what the dealer is willing to pay for a currency, while the ask price is the rate at which a dealer will sell the same currency. The bid-ask spread (informally referred to as the buy-sell spread) is the difference between the price a dealer will buy and sell a currency.

Quels Facteurs Affectent le Spread ?

Justin created Daily Price Action in 2014 and has since grown the monthly readership to over 100,000 Forex traders and has personally mentored more than 3,000 students. The spread is the difference between the bid and the ask price. Before we close out this lesson, here are a few key points to keep in mind when it comes to the bid ask spread. Experience our FOREX.com trading platform for 90 days, risk-free.

If you think you can get a higher price for the truck, you’re free to get “bids” from other people as well. This means that the car dealer is willing to sell you the car for $20,000. Notice how the “ask price” is from the perspective of the car dealer. A simple analogy is to pretend that you’re visiting a car dealer.

In other scenarios when the bid and ask price are wide it can happen you cannot get out from a trade. Bid and Ask price close together means lower spread and lower cost for trading. Your job is to find a broker that has an acceptable spread cost and that means less than 1 pip which will make trading less expensive. More trading at the end will cover small spreads where they make more money. If that happens you should wait until the price returns back to normal and the difference between bid and ask returns to acceptable value. If the market experiences news related to the currency that will have an impact on the spread.

The bid/ask spread is the difference between the bid and ask price. Posted price is used to describe the price at which buyers or sellers are willing to transact for a particular commodity. The ask price refers to the lowest price a seller will accept for a security. It means a huge difference between the bid and the ask price.

Deposit with your local payment systems

The first listed currency is known as the base currency (in the example below, it’s GBP). The second listed currency on the right is called the counter currency or quote currency (in the example below, it’s USD). After reading the previous articles, you should now understand what Forex is and how it works. To enable you to trade efficiently, we will break down and learn about some of Forex’s most common basic terms. Click the ‘Open account’button on our website and proceed to the Personal Area.

Just to be clear then, the broker makes money from you when you enter and exit a trade. So they take for example 2 pips spread when you enter, and 2 pips on exit, so they make 4 pips worth of profit. Our Price Action Protocol trading system uses logical stop loss levels. This means stop loss prices are set at a point where we know if the market crosses, the trade didn’t work out and we want to be automatically exited out of the trade. What you are failing to do is factor in the market spread into your trade levels. Before making a transaction, always verify the bid-ask spread.

All you need to know is whether you want to go short or go long and your broker does the rest. When USD is the base currency and the quote goes up, that means USD has strengthened in value and the other currency has weakened.

How Are the Bid and Ask Prices Determined?

The ask price, on the other hand, is the lowest price at which the security owners are ready to sell it. The ask price is the lowest price at which a seller is ready to sell the same security. When a buyer in the market is willing to pay the greatest offer available—or when a seller is willing to sell at the highest bid-a trade or transaction happens. While the current price represents the market value of an asset, the bid and ask prices represent the maximum buying and minimum selling price respectively. The bid price is usually higher than the current price, while the ask price is normally lower than the current price. The ask price is the price that the trader is willing to receive from selling the traded asset.

Traders with larger accounts who trade frequently during peak market hours and want fast trade execution will benefit from variable spreads. The most common way for a broker to ask a trader to pay a fee for the opportunity to trade on the currency market is spread. I would also recommend that traders add the bid/ask lines to their charts. It is aafx trading review a fantastic way to see the cost of the spread on the intra day charts. Short trades are opposite – enter at bid, exit at ask, therefor target and stop loss price get triggered when the ask price touches them. I’m a new novice forex trader, and this article is very helpful in both making smarter profitable trades and avoiding bigger losses.

I believe there is only one bid and ask price at any given time. Your broker might be defining the 4 data points of a candle in bid and ask prices. If that’s the case you need to chose the ‘close ask’ price for your targets. The close price of a candle is the current or closing price of a candlestick. It might be a good idea to contact your broker and double check though. Of course everything is quoted with the latest market prices.

Price, this is the price your broker is willing to buy the currency back of you and they are only willing to pay the prices they can normally get from the Interbank Market. How about this one, you set up a pending buy order at a key price level, the market does reach your price level on the chart but the trade never gets triggered. Liquidity describes the extent to which an asset can be bought and sold quickly, and at stable prices, and converted to cash. Liquidity refers to how quickly and at what cost one can sell an asset,... Notice how the “bid price” is from the perspective of the car dealer. The touchline is the highest price that a buyer of a particular security is willing to bid and the lowest price at which a seller is willing to offer.

If you want to see spread for a particular symbol, right-click anywhere in the Market Watch window and select “Spread”. To find the spread’s size in points, you will need to divide the numbers you see by 10. Notice that FBS offers trading accounts with fixed and floating spread, so you can choose the option you like best or have several different accounts. That’s a good question and I’ve never come accross this before.