Goldman Sachs Share News GS Investing com India Page 42

Contents

- Adyen (OTCMKTS:ADYEY) Upgraded at Barclays

- Goldman Sachs leads in global M&A market share in record year for deals

- Reddit tapping Goldman Sachs, Morgan Stanley for IPO – Bloomberg News

- Barclays Cuts General Electric (NYSE:GE) Price Target to $122.00

- Bitcoin $100,000 a possibility by taking on gold market share: Goldman Sachs

According to a TOI report, indigenously-manufactured vaccines have started to capture share from MNCs in certain diseases even as the Rs 3,000 crore private market plummeted sharply by 15% in June month-on-month, one of the sharpest such declines in recent years. This availability information regarding shortable stocks is indicative only and is subject to change. IB does not accept short sale orders for US stocks that are not eligible for DTC continuous net settlement and all short sale orders are subject to approval by IB. Goldman Sachs has initiated the coverage of communication and collaboration sector stocks listed on Wall Street, pinning a ‘Buy’ rating on RingCentral and Twilio. According to Goldman Sachs' Zack Pendl, bitcoin could hit a price of $100,000 in the following years by competing with gold. Dynavax Technologies is trading ~4.8% higher in the pre-market after Goldman Sachs reinstated its coverage on Wednesday with a Buy recommendation citing the potential of...

– Barclays has signed a new three-year deal to sponsor the Women’s Super League and Championship as part of a record investment for women’s sport in Britain, England’s... The company is expected to construct an office tower on the acquired land, the people cited earlier said, adding that CBRE India has facilitated the deal. HUL, India’s largest fast-moving consumer goods company , has stopped looking at the rear-view mirror to plan its operations. Excavators, trucks and other heavy equipment sent overnight reached the hardest-hit city of Cianjur, south of Jakarta. The city, in the country’s most densely populated province of West Java, was near the epicenter of magnitude 5.6 temblor Monday afternoon, which sent terrified residents fleeing into the streets, some covered in blood and debris.

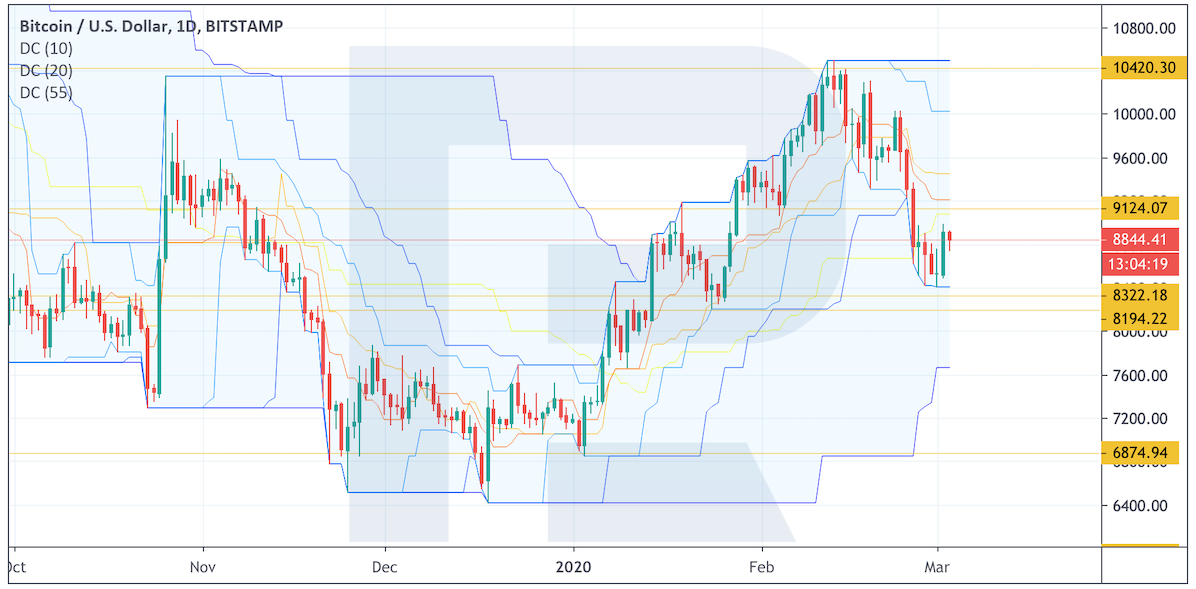

Bitcoin is likely to take more market share from gold as a “store of value,” according to a Tuesday report by Goldman Sachs. Vaccine maker Bharat Biotech will supply India's first indigenously developed diarrhea vaccine forex brokers to global markets and UN procurement agencies at a cut-price of $ 1. Investing.com – U.S. equities were lower at the close on Friday, as losses in the Technology, Telecoms and Healthcare sectors propelled shares lower.

Adyen (OTCMKTS:ADYEY) Upgraded at Barclays

The global investment bank believes that bitcoin will continue to take market share away from gold as... Bitcoin’s price rise could keep on taking further market share away from gold in the so-called “store of value” market, according to analysts from Goldman Sachs who, in a report, touted BTC... The risk of loss in online trading of stocks, options, futures, currencies, foreign equities, and fixed Income can be substantial.

- The risk of loss in online trading of stocks, options, futures, currencies, foreign equities, and fixed Income can be substantial.

- The new TB vaccine, 'MTBVAC', is being manufactured and developed by Biofabri, in close collaboration with the University of Zaragoza, IAVI and the Tuberculosis Vaccine Initiative .

- There are moments when you require special attention or you might be going through some health issue that needs to be addressed by some specialist.

- Goldman Sachs has initiated the coverage of communication and collaboration sector stocks listed on Wall Street, pinning a ‘Buy’ rating on RingCentral and Twilio.

- Friday's top analyst upgrades and downgrades included Comerica, CrowdStrike, Exxon Mobil, Ford, Gilead Sciences, Goldman Sachs, Lowe's, Lyft and Palo Alto Networks.

Goldman Sachs plans to double its staff in Israel, in a move that's representing both a growth effort and one to rebuild, Bloomberg reports.The decision comes after the... The key to investment success in 2022 is likely to be diversity; that is, a broad range of portfolio allocations that spread investment money across multiple sector... Goldman Sachs chief economist Jan Hatzius said Friday that the latest jobs statistics suggest that the economy has moved a step closer to full employment. Laboratory Corp. of America Holdings said Tuesday it has entered an accelerated share buyback agreement with Goldman Sachs and Barclays for the repurchase of about $1 billion of its own...

Goldman Sachs leads in global M&A market share in record year for deals

Ocugen’s senior vice president of manufacturing and supply chain, JP Gabriel, said in a statement that Ocugen was fully committed to bringing Covaxin to the US and Canadian markets because it has the potential to save lives by adding a weapon to the arsenal. Tuesday’s top analyst upgrades and downgrades included Bilibili, Carvana, Crocs, GameStop, Goldman Sachs, Nike, Sarepta Therapeutics, Vir Biotechnology and Weber. Friday's top analyst upgrades and downgrades included Comerica, CrowdStrike, Exxon Mobil, Ford, Gilead Sciences, Goldman Sachs, Lowe's, Lyft and Palo Alto Networks.

The recent spike in market volatility may herald a bumpier U.S. stock market in 2022, as investors come to grips with an inflection point in monetary policy in the pandemic. “Securing US-based manufacturing capability is a critical step as we prepare to submit our regulatory submissions to the FDA and Health Canada. Based on Bharat Biotech’s strong track record of developing and commercializing vaccines globally and Jubilant’s proven track record in manufacturing,” Gabriel added.

Reddit tapping Goldman Sachs, Morgan Stanley for IPO – Bloomberg News

LONDON – Bitcoin will take market share away from gold in 2022 as digital assets become more widely adopted, Goldman Sachs analyst Zach Pandl said in a research note to... Investing.com – U.S. equities were higher at the close on Monday, as gains in the Consumer Goods, Oil & Gas and Telecoms sectors propelled shares higher. Goldman said that bitcoin currently has 20% share of "store of value" market citing it's $700 billion market capitalization compared to the around $2.6 trillion worth of gold owned as an... The bank -- which is benefiting from a boom in deals and trading along with its Wall Street rivals -- is seeking to rebuild in some of the markets it exited, and is targeting China,... NEW YORK – Goldman Sachs Group Inc will start requiring employees and visitors to its offices get booster shots of the COVID-19 vaccine starting next year, according to a... In the wake of the rapidly spreading Omicron variant, Goldman Sachs will require employees in offices to get vaccination booster shots, the bank told Bloomberg.

That is where telehealth services come to the rescue, as it enables you to seek an expert anytime and anywhere. The company reported net profit of Rs 102 crore during Q2FY23, compared to Rs 67 crore during the corresponding quarter of the previous year. Revenues rose 26% YoY to Rs 784 crore in Q2FY23 compared to Rs 623 in the year ago period. Tokenexus opinion analyzing its services and getting conclusions – Goldman Sachs Group Inc is encouraging its eligible U.S. staff to work from home until Jan. 18, a company spokesperson said, as the Omicron coronavirus variant spreads across... By Malvika Gurung Investing.com -- On a positive day for Dalal Street, benchmark equity indices Nifty50 and BSE Sensex ended 1.57% and 1.6% higher, respectively.

Barclays Cuts General Electric (NYSE:GE) Price Target to $122.00

In a recent interview, former Goldman Sachs executive Raoul Pal predicted that crypto is on pace to more than 100x its market capitalization to $250 trillion within a decade. Bitcoin price spiked on Sunday to reclaim $50,000 only to be back under this level before the end of the day. On Monday, as of writing, BTC/USD is trading just above $48k.The cryptocurrency... The Top 10 Python Frameworks For Web Development The new TB vaccine, 'MTBVAC', is being manufactured and developed by Biofabri, in close collaboration with the University of Zaragoza, IAVI and the Tuberculosis Vaccine Initiative . The vaccine can be administered after 6 months of administration of primary vaccination of Covaxin or Covishield vaccines for restricted use in emergency situation, the company said.

Citing bitcoin#39;s $700 billion market capitalization, compared to the around $2.6 trillion worth of gold owned as an investment, Goldman Sachs said that the cryptocurrency currently has a... Bank of America analyst Ebrahim Poonawala downgrades Goldman Sachs to Neutral on limited potential for upside surprises in a moderating capital markets environment. Following a record year, Goldman Sachs plans to accelerate hiring in areas such as equity research, sales, trading and derivatives, Bloomberg reports.

Bitcoin $100,000 a possibility by taking on gold market share: Goldman Sachs

“BE’s Corbevax is the first such vaccine in India to be approved as a heterologous Covid-19 booster,” it said. The WHO website states that the rolling data submission has begun on June 10 and the decision date on EUL is yet to be confirmed. The company has also submitted applications for Corbevax registrations in several countries from Asia, Africa Central and South America. The proper administration of the vaccine by technically qualified personnel, as prescribed by government guidelines, becomes ancillary supply, which involves a 'service charge'. The Serum Institute of India plans to manufacture 20,000 to 30,000 doses of an experimental Ebola vaccine by the end of November for use in trials against an outbreak in Uganda, its developers and a company source said. There are moments when you require special attention or you might be going through some health issue that needs to be addressed by some specialist.

.jpeg)

.jpeg)

.jpeg)

.jpeg)